More than one-third of exports from African countries are believed to originate from the mining industry, and estimated to contribute approximately 4.5% to the continent's GDP.

Africa holds a substantial portion of the world's critical mineral and rare earth metal reserves, including 92% of the global platinum supply, 56% of cobalt, 54% of manganese, and 36% of chromium. These minerals are essential for producing green technologies, such as electric vehicle (EV) batteries and wind turbines.

The export of raw materials predominantly consists of raw minerals with minimal value addition and this is a major bane of the extractive minerals industry

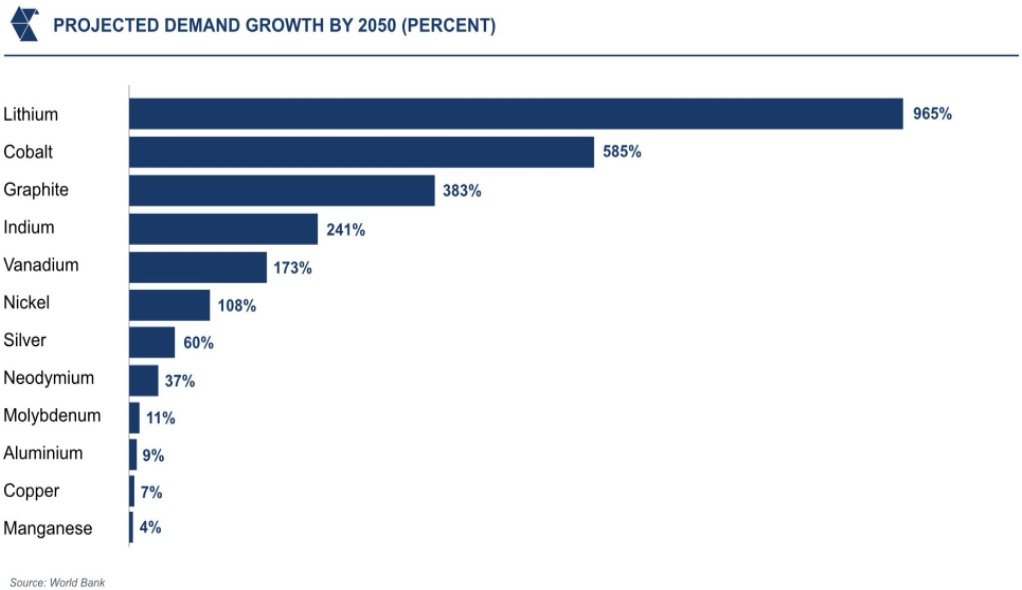

Critical energy transition minerals such as copper, lithium, nickel, cobalt and rare earth elements are essential components in many of today’s rapidly growing clean energy technologies – from wind turbines and solar panels to electric vehicles and battery storage.

The mineral resources and rare earth metals available in Africa will prove to be extremely vital in feeding the growth of renewable energy sectors, be it battery production, wind and solar energy equipment production, components of electric vehicles etc.

According to the UN Secretary General, “A world powered by renewables is a world hungry for critical minerals. For developing countries, critical minerals are a critical opportunity – to create jobs, diversify economies, and dramatically boost revenues. But only if they are managed properly. The race to net zero cannot trample over the poor. The renewables revolution is happening – but we must guide it towards justice.

In-spite of all its comparative advantages in this sector, Africa still lags behind in mining sophistication, with a great part being largely artisanal and a major pit to port mentality, with value chain not being properly developed.

The project's key focus is on empowering indigenous participants in Africa's critical extractive minerals and mining sector.

Despite the significant potential to boost the African economy by billions of dollars, there is a lack of strong local market players in these sectors, primarily due to limited access to flexible and quick financing options. Existing commercial banks and development financing institutions do not adequately address this need.

To bridge this gap, the African Extractive Minerals Development Bank is being established. This specialized multilateral financial institution will provide dedicated funding to these key industries. It will emphasize clean energy credentials and contribute to net zero carbon goals.

Collaboration will involve sovereign states, development and multilateral financial institutions, traditional banks, and private sector investors. Detailed information about the Bank is provided in the Information Memorandum.

The bank supporting the mining sector in Africa operates under a public/private partnership model designed to address the unique funding needs within the extractive minerals sector.

African countries hold Class A shares, ensuring that the bank maintains a strong focus on the continent’s developmental needs and priorities.

The African private sector owns Class B shares, promoting private sector investment and encouraging a market-driven approach to project financing.

Non-African countries and the private sector hold Class C shares, diversifying the investment base and bringing in international expertise and capital.

Management teams work alongside the Board to implement strategies and ensure operational efficiency.

The primary focus of the bank is on closing funding gaps in the extractive minerals sector, providing tailored financial solutions to enable the development of mining infrastructure and operations crucial for economic growth in Africa.

The structured approach of having distinct classes of shares and a robust governance framework allows the bank to effectively support and develop the mining sector in Africa, addressing both immediate and long-term financial needs.

The bank will play a crucial role in providing catalyst funding, which kick-starts mining projects and attracts further investments.

It will offer early stage capital that reduces the financial burden on mining companies and accelerates project timelines by providing the necessary financial resources for exploration and initial development.

The bank will be critical for infrastructure financing, funding the development of crucial infrastructure such as roads, power supply, and water systems, which improves operational efficiency and access to remote mining locations.

The bank will support value chain development by financing the entire mining value chain from extraction to processing and distribution, thereby enhancing the overall economic contribution of the mining sector and creating jobs.

It is believed a symbiotic handshake between the Government and the financial sector remains crucial in tapping into the value addition in the mining of minerals for production purposes.

The bank will be essential for the African mineral sector to capitalize on the projected massive increases in demand for critical minerals, driven by the renewable energy sector. With certain minerals like lithium expected to see demand surges of up to 1,500 percent, the bank can provide the necessary financial support and infrastructure. This support is crucial as global revenues from extracting crucial metals are estimated to reach approximately USD 16 trillion by 2050.

The bank will be crucial for Africa's mineral sector to leverage its significant role in the global critical minerals market. With Africa holding about 30 percent of the world's reserves, particularly rich in platinum group metals, cobalt, and manganese, developing local processing industries can enhance value addition and spur economic benefits. Addressing the pronounced USD 225 billion investment shortfall in mining projects is essential to meeting future demands, despite geo-political and economic challenges.